empower retirement loan application

Empower Retirement 8515 E. You will only be able to check the status of a mobile.

Empower Retirement Reviews 2022

_____ _____ Spouses Signature Date C.

. Empower Retirement acquired MassMutuals retirement plan business in January 2021. Application for Policy Loan FR2066. Through a focus on an individuals goals and.

EFSI is an affiliate of Empower Retirement LLC. Taking a loan from your 401k You can usually take out a loan from a 401k account without taxes and penalties typically up to 50000 or 50 percent of the assets. Please do not put any confidential or personal account information in an email request.

If you need to send us confidential. Object moved this document may be found. Opening Doors - Empower.

Interest Rate on LoanThe percent interest. Apply via our NEW Streamlined Mobile Application by clicking on Mobile Application below. Loan AmountHow much you plan to borrow from your retirement account.

Empower Retirement 1-866-745-5766 ORRegular Mail to. Empower Personal Loans are intended for any purpose that may enhance our members lives. We would like to show you a description here but the site wont allow us.

At Empower were helping millions of Americans drive toward the financial future they richly deserve. You can also check your loan balance by calling our automated. Sign in to your account and select Manage my Loans to see a list of your loans and to choose which one you want to pay.

Loans are initiated when the participant applies for a loan via paper application the Web site or KeyTalk as allowed by the Plan. Experience a faster way to. Empower Retirement PO Box 173764 Denver CO 80217-3764 Express Mail to.

Browse Empower Institute for cutting-edge research and actionable insights. The new rules. There are times in our lives when we have expected or unexpected expenses.

The Promissory Note and Loan Check are combined into one. In response to economic fallout from COVID-19 plan provider will not charge for some transactions GREENWOOD VILLAGE Colo April 2 2020 Empower Retirement is. Time was the requirement for repaying a loan taken from your 401-retirement account after leaving a job was 60 days or else pay the piper when you file your.

Use the button below to access your retirement plan account. With My Total Retirement from Empower your customized investment plan is professionally managed undergoes ongoing reviews and adjusts with you. Get the latest on legislative regulatory activities.

Witness of Spousal Consent. Loan as described herein in the Loan Application and Agreement and as described in the Plan. Loans your plan allows you to borrow up to 50 of your account balance.

Colorado Based Empower Retirement To Take Over Prudential Financial S Retirement Business

Easy Direct Deposit With Empower Fcu

Empower Federal Credit Union Banking Loans In Syracuse Ny

The Real Cost Of Loans Empower

Empower Personal Finance App Review It Found Me Hidden Savings

Empower Retirement Waives Fees On Loans And Hardship Withdrawals

Empower Review 2022 The College Investor

Empower Retirement Reviews 2022

How To Read A 401 K Statement And Understand It 401k Maneuver

Empower Retirement Reviews 2022

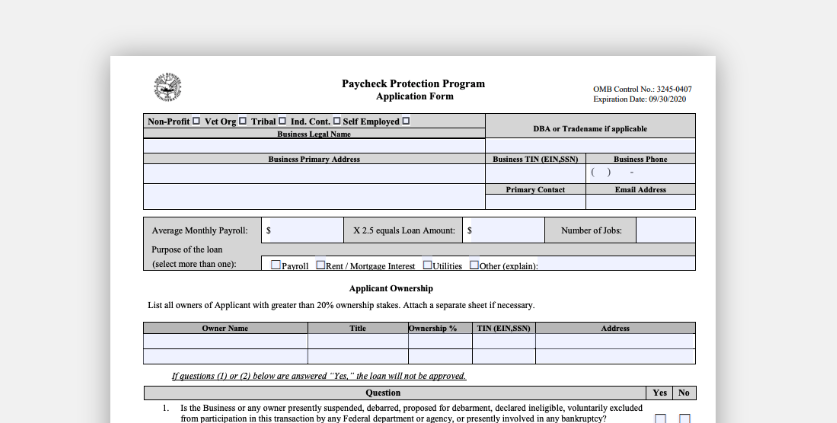

Paycheck Protection Program Application And Required Documents Cares Act

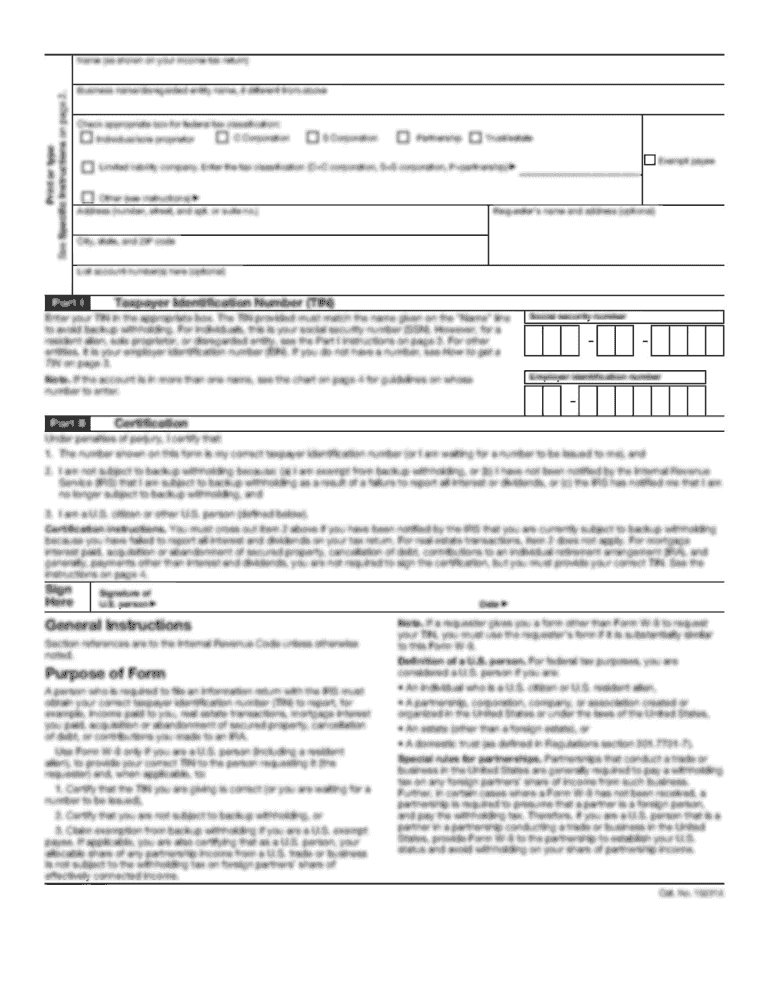

20 Printable Retirement Withdrawal Strategies Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

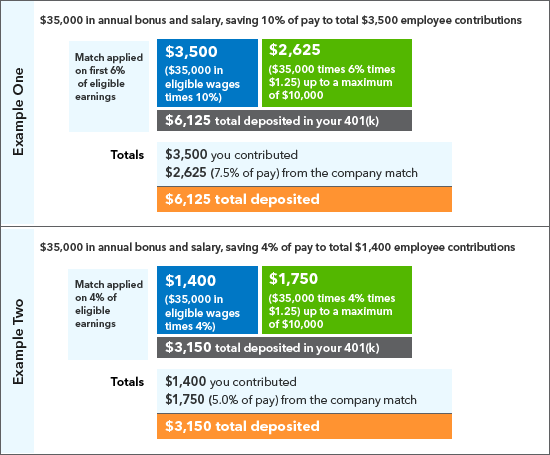

401 K Savings Plan Intuit Expert Benefits

Retirement As A Last Resort Advisor Magazine

Empower Retirement Loan Application Fill And Sign Printable Template Online Us Legal Forms